The industrial real estate market has been undergoing a seismic shift across the United States, with Phoenix rapidly emerging as one of the hottest markets in the country. Fueled by record population growth, corporate relocations, and global supply chain realignment, the Phoenix Metro—and surrounding growth corridors—are drawing the attention of institutional investors, private equity groups, and high-net-worth individuals seeking reliable, high-growth opportunities.

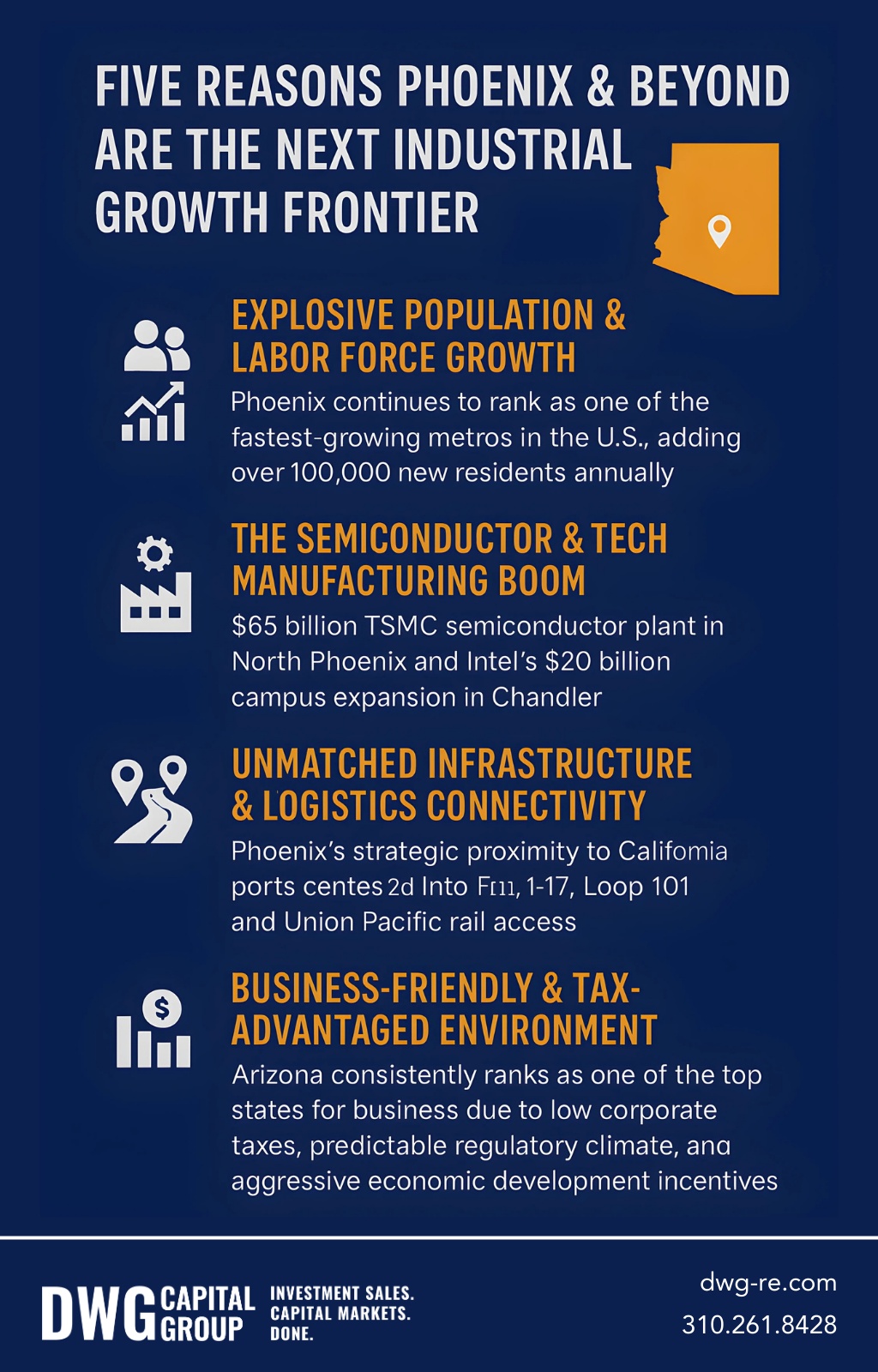

Here are five reasons why Phoenix and its surrounding markets are becoming the next industrial growth frontier:

1. Explosive Population & Labor Force Growth

1. Explosive Population & Labor Force GrowthPhoenix continues to rank as one of the fastest-growing metros in the U.S., adding over 100,000 new residents annually. This influx brings a younger, skilled labor force, ideal for supporting logistics, e-commerce, and advanced manufacturing sectors. Companies are following the people—driving demand for distribution centers, warehouses, and industrial facilities at an unprecedented pace.

The $65 billion TSMC semiconductor plant in North Phoenix has become a catalyst for industrial expansion across the region. Alongside Intel’s $20 billion campus expansion in Chandler, these megaprojects are attracting suppliers, logistics firms, and advanced manufacturing tenants, creating a ripple effect of demand for industrial space and infrastructure throughout Arizona.

Phoenix offers strategic proximity to California ports without the high taxes and regulatory burdens. With I-10, I-17, Loop 101, and Union Pacific rail access, the region connects efficiently to Los Angeles, Las Vegas, El Paso, and beyond, making it a prime hub for last-mile delivery, regional distribution, and cross-border trade with Mexico.

Arizona consistently ranks as one of the top states for business thanks to its low corporate taxes, predictable regulatory climate, and aggressive economic development incentives. These advantages lower operating costs for tenants and create favorable investment conditions for buyers seeking income stability and long-term appreciation.

Industrial vacancy rates in Phoenix remain **historically low—below 4% in many submarkets—**with rental rates rising over 20% year-over-year in some industrial corridors. Limited land availability near key transportation hubs and population centers is pushing both property values and rents higher, ensuring strong landlord leverage and investor upside.

Phoenix and its surrounding markets have evolved into national industrial powerhouses, blending demographic growth, infrastructure investment, and corporate expansion into a formula for long-term success. For investors seeking stable income today and significant appreciation tomorrow, Phoenix stands as a frontier market poised for continued transformation.

At DWG Capital Group, we specialize in sourcing and structuring industrial real estate opportunities in high-growth markets like Phoenix, aligning investor capital with assets positioned for enduring success.

Offices in Dallas, Fort Worth, Los Angeles and Nationwide.

jdunning@dwg-re.com

LA Tel: 310.261.8428

TX Tel: 972.738.8586

President Principal

License #01520854

Beyond our Award-Winning Brokerage, we are also Principals.

Visit our Sister Industrial Investment Firm, LP

Send us your inquiry or contact us directly.

President & Principal

LA Tel: 310.261.8428

TX Tel: 972.738.8586