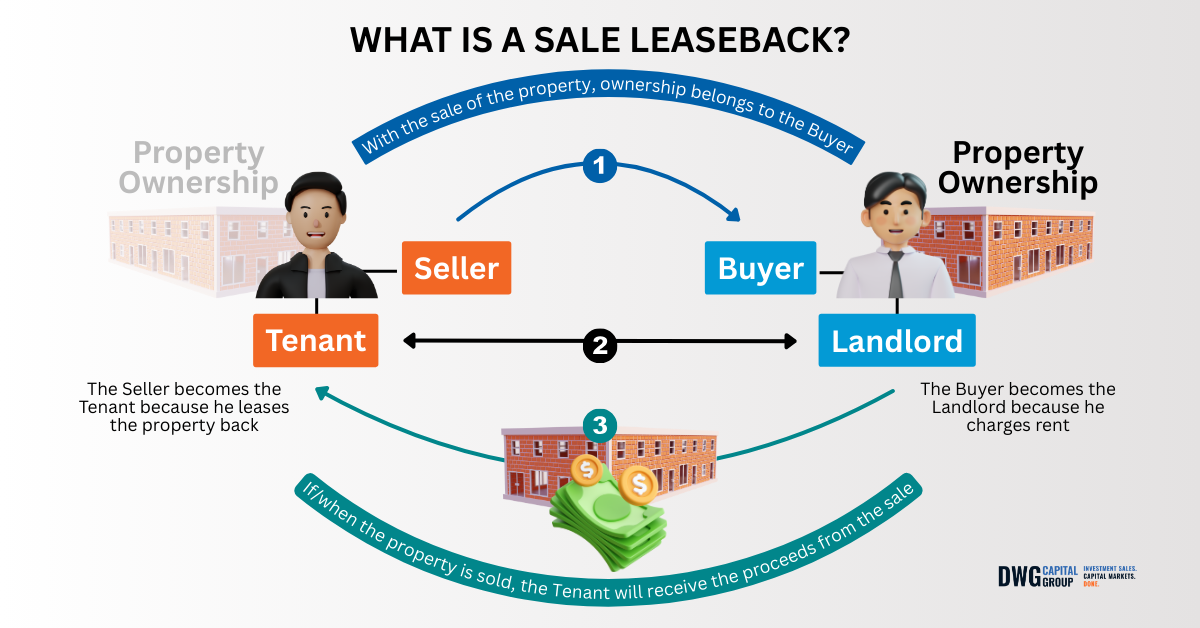

In today’s competitive real estate market, investors seeking stability, predictable cash flow, and long-term appreciation are turning to industrial sale-leaseback acquisitions as a powerful strategy to optimize their 1031 exchanges. At DWG Capital Group, we specialize in structuring these opportunities, helping clients transition capital efficiently while securing high-quality, income-producing assets.

The appeal of industrial real estate has never been stronger. E-commerce growth, advanced manufacturing, and supply chain demand have fueled historically low vacancy rates and robust rent growth across markets like Phoenix and other U.S. logistics hubs. Within this environment, the sale-leaseback model offers a unique advantage for 1031 investors:

Stable, Bond-Like Income – Long-term leases with creditworthy tenants ensure reliable NOI, often with built-in rent escalations.

Passive Management – Triple-net lease structures shift operating expenses to tenants, creating low-maintenance investments.

Immediate Deployment – Sale-leasebacks often come pre-structured, enabling buyers to meet the strict 1031 timelines.

Tax Efficiency & Upside – Investors benefit from deferring capital gains taxes while gaining exposure to assets with strong appreciation potential.

One of the greatest challenges in executing a 1031 exchange is aligning timing, quality, and yield. With sale-leaseback opportunities, investors can secure institutional-quality industrial assets with predictable income streams, minimizing risk while achieving compliance with IRS exchange deadlines. Properties are typically leased to the seller-tenant on long-term terms, ensuring immediate occupancy, established operations, and consistent rent.

DWG Capital Group: Your Sale-Leaseback Partner

DWG Capital Group: Your Sale-Leaseback PartnerAt DWG Capital Group, we combine institutional transaction experience with boutique-level service, helping high-net-worth individuals, family offices, and institutional investors identify, analyze, and acquire industrial sale-leaseback opportunities nationwide. Our team has advised on over $2B in commercial real estate transactions, with a focus on industrial, office, and distribution assets that align with 1031 exchange needs.

We work closely with investors to:

Source exclusive, off-market sale-leaseback deals.

Provide underwriting and financial modeling for 1031 suitability.

Negotiate favorable lease terms that enhance long-term returns.

Deliver seamless execution under strict exchange deadlines.

A well-structured industrial sale-leaseback can transform a 1031 exchange into a strategic portfolio enhancement, offering investors long-term stability, tax efficiency, and access to some of the most resilient assets in commercial real estate. At DWG Capital Group, our mission is to help clients maximize these opportunities with confidence and clarity.

If you’re considering a 1031 exchange and want to explore sale-leaseback options in the industrial sector, contact DWG Capital Group today. Our seasoned advisors are here to deliver exceptional results through institutional experience, market insight, and execution you can trust.

Offices in Dallas, Fort Worth, Los Angeles and Nationwide.

jdunning@dwg-re.com

LA Tel: 310.261.8428

TX Tel: 972.738.8586

President Principal

License #01520854

Beyond our Award-Winning Brokerage, we are also Principals.

Visit our Sister Industrial Investment Firm, LP

Send us your inquiry or contact us directly.

President & Principal

LA Tel: 310.261.8428

TX Tel: 972.738.8586