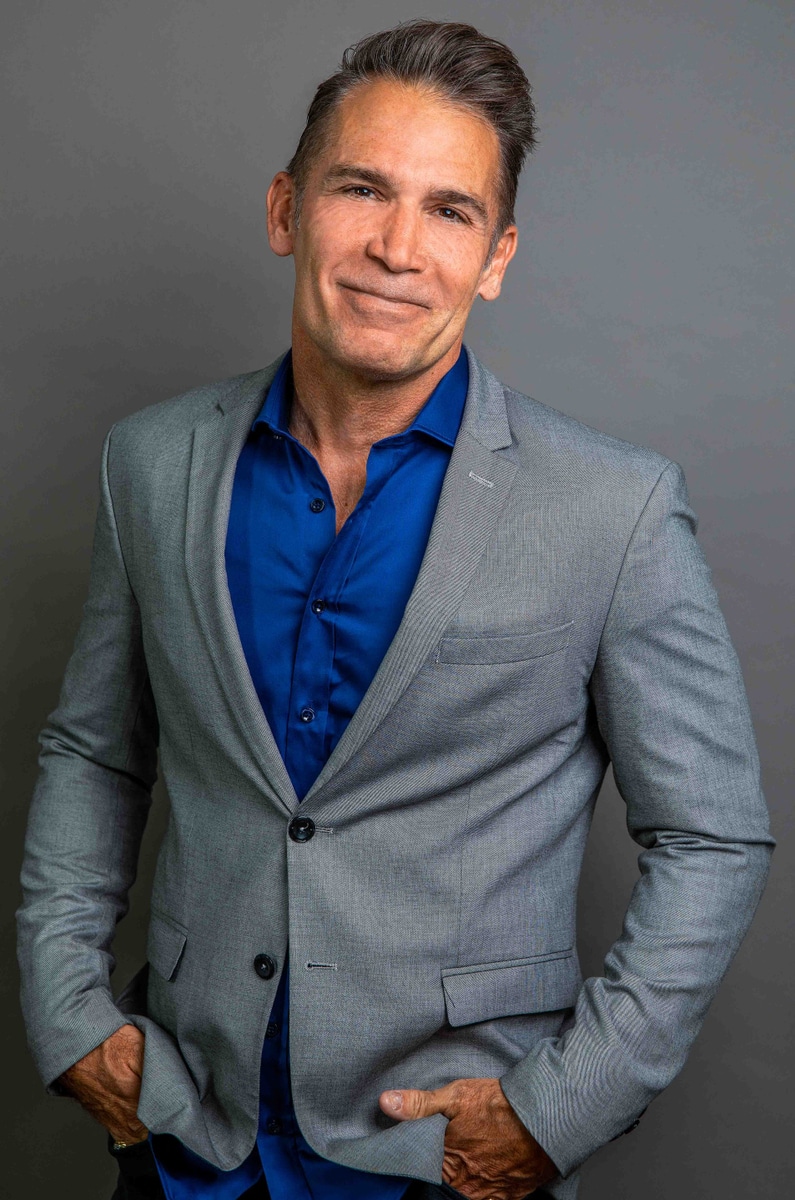

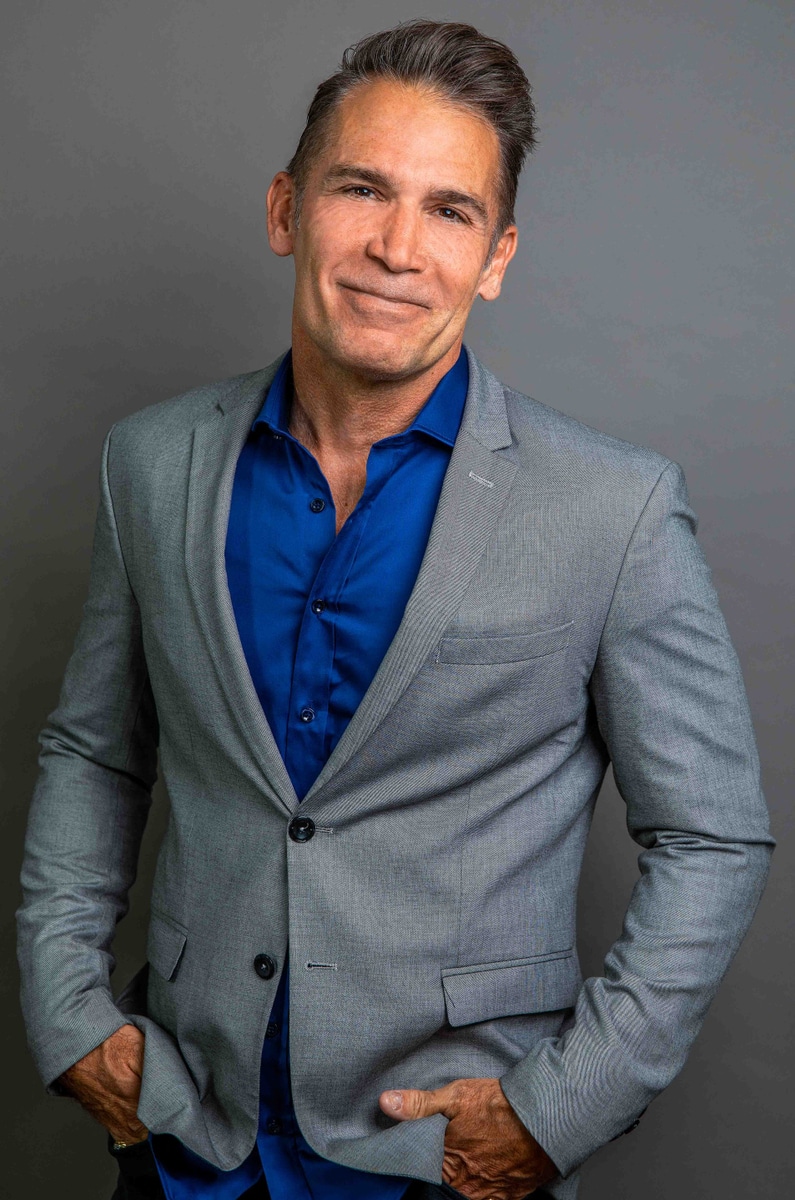

Judd Dunning has received numerous accolades for his contributions to the real estate industry. He was the recipient of the 2022 Los Angeles Business Journal “Community Impact Deal of the Year” Gold Award, and a nominee for Broker Executive of the Year. In 2021, he was honored with the CoStar Power Broker award.

With a proven track record in capital markets advisory and a history of transactions across 38 states, Mr. Dunning has orchestrated significant deals, including a $165 million transaction involving a Sony Animation NNN single-tenant S&P-rated A credit office portfolio in West Los Angeles and a $130 million deal for a Class A retail property.

DWG Capital Partners and DWG Capital Group continue to excel in providing exceptional service to partners and clients, solidifying their reputation among the premier CRE firms in the nation.

PRESIDENT/PRINCIPAL

JUDD DUNNING

Judd Dunning is a distinguished third-generation real estate executive with two decades of experience in institutional commercial real estate. As President of DWG Capital Group and DWG Capital Partners, he brings a wealth of national expertise in orchestrating institutional investment sales and capital markets transactions following years as a top producer of Newmark/ARA and founding member of Newmark Capital Markets in West Los Angeles. Leveraging his extensive network and deep market knowledge, Dunning employs a strategic NNN industrial sale-leaseback approach through DWG Capital Partners, successfully navigating market complexities to deliver superior outcomes.

Under Dunning’s leadership, DWG Capital Group has achieved significant milestones, closing approximately $1 billion in investment sales and debt/equity placements in the past 24 months. Dunning’s client roster includes prominent institutions, funds, and private companies. His expertise extends across various asset classes, including retail, office spaces, industrial facilities, apartment complexes, and development projects.